Products

| Highlights |

TIBS Collateral

TIBS Collateral offers a powerful platform in which bank users can create custom asset types that can be used as collaterals. TIBS Collateral monitors and automatically updates the collaterals in the bank's custody.

- User-definable collateral asset types

- Multiple pledge asset items per collateral application

- Multiple credit lines per collateral application

- Collateral items and supporting documents custody

- Print collateral application on demand

- Charge on account for deposits and shares

- Automatic hold fund for deposits to be pledged

- Auto-changing of collateral status

- Collateral allocation for supporting credit limits

Build your own collateral asset types

Extensive collateral type maintenance platform allows bank users to create custom asset types for collateral by defining the asset types' attributes, application life cycle, discount rules, supporting document type list, and specialized business logic.

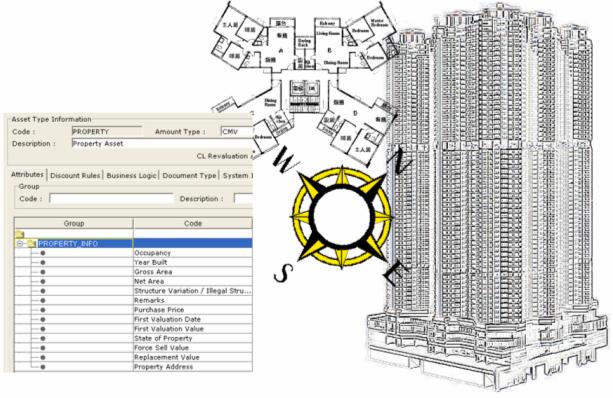

Custom Asset Types and Attributes

TIBS Collateral does not limit you to a preset list of asset types that can be used as collaterals. The Collateral Assets Platform enable bank users to readily create custom asset types, without the need for IT personnel involvement and costly development and testing cycles. Bank users may select from a list of currently available attributes to describe the new asset type, or even create new attributes to add to the list. The selected attributes are set to be mandatory or optional. Asset types can also be set up to have credit limits affected when the current market value for that asset has been changed.

Discount rules

Discount rules are easily set for both collateral value and related credit facility types. This enables the system to calculate the value of the collateral item at discount (providing a cushion for value fluctuation), and subsequently updates the credit limit of the facility. This discount rule capability helps minimize the market risk of frequently fluctuating pledged assets.

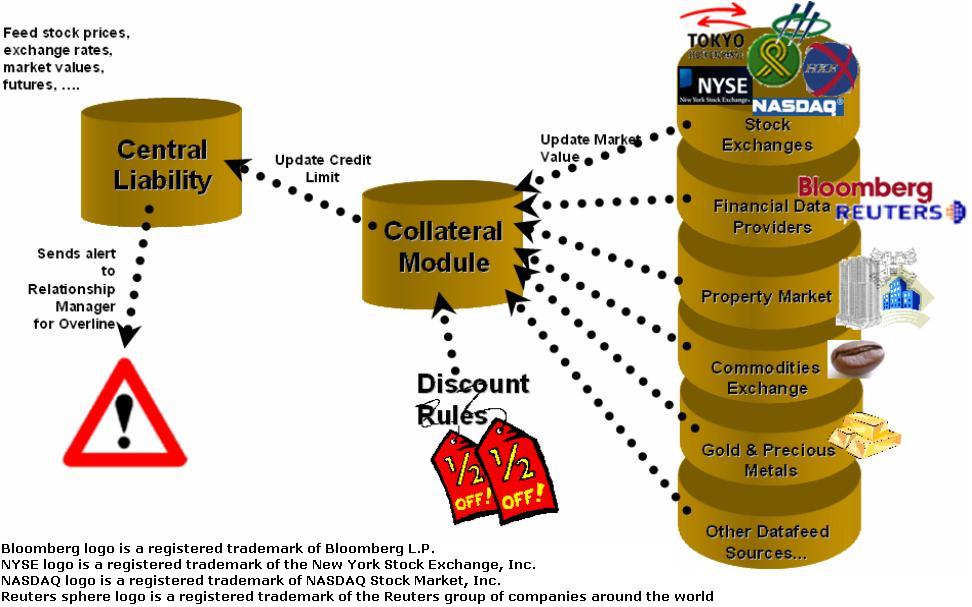

Datafeed enabled for CMV revaluation

Asset items like shares and properties have current market values (CMV) that fluctuate. TIBS Collateral is datafeed-enabled, ready to accept prices and other CMV information from rate feeds, exchanges, and other data sources.