Products

| Highlights |

TIBS Customer Profile (CIF)

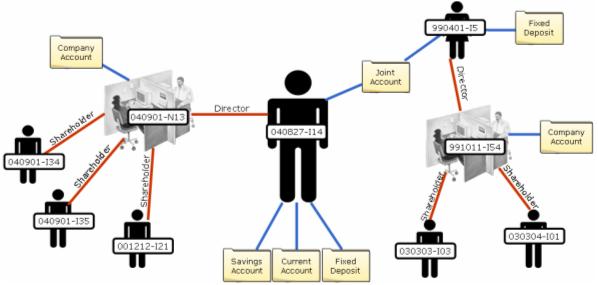

TIBS Customer Profile provides comprehensive analysis codes and demographic information needed for CRM. With its advanced customer relationship mapping mechanism, bank users have a full view of bank customers' assets and liabilities in a single screen.

- Customer relationship mapping

- Full customer profile view

- Special persons matching

- Group customer for credit facilities sharing

- Advance Controls

- NameControl for single-byte languages

- NameControl for double-byte languages

- different address formats for different countries with AddressControl

- Comprehensive analysis codes for CRM

Customer Profile View

With the built-in customer relationship mapping mechanism, TIBS Customer Profile provides a comprehensive view of any customer on a single enquiry screen. Information provided by TIBS Customer Profile includes, not only the customer's total assets, liabilities and performances, but also the direct and indirect relationships with other customers and their total assets, liabilities and performances. Assets of the customer include deposits, investments, collaterals and custodies. Liabilities of the customer include credit facilities granted, credit limits, utilization, earmarked amount and available balance. Further drill down to view the details of the loan records utilizing the credit line is also provided. Account performance, such as account balance, highest/lowest balance, turnover, number of return cheques etc., can also be viewed.

Group Customer

TIBS Customer Profile allows bank users to create group customer profile for a group of customers which shares credit facilities. This helps bank users to see the complete picture of the group and make appropriate judgement for granting credit facilities to these customers.