Products

| Highlights |

TIBS Retail Banking

TIBS Retail Banking is a full-featured retail banking system. TechnoSolve has identified the constants and variabilities in characteristics of different retail products and created a platform that allows bank users to easily pick, choose and adjust these characteristics to put into their products without the need for costly development work and testing cycles.

- User-definable product management

- User-definable charge management

- Sophisticated interest structure and calculation

- Fees and charges management

- Various transactions for savings, currents and time deposit

- Comprehensive enquiry transactions

- Hold fund / float fund management

- Hold code management

- Consolidated statements

- Channel integration

- Inward / outward clearing

- Teller cashier management

- Money exchange

- Gift cheque and cashier order transaction

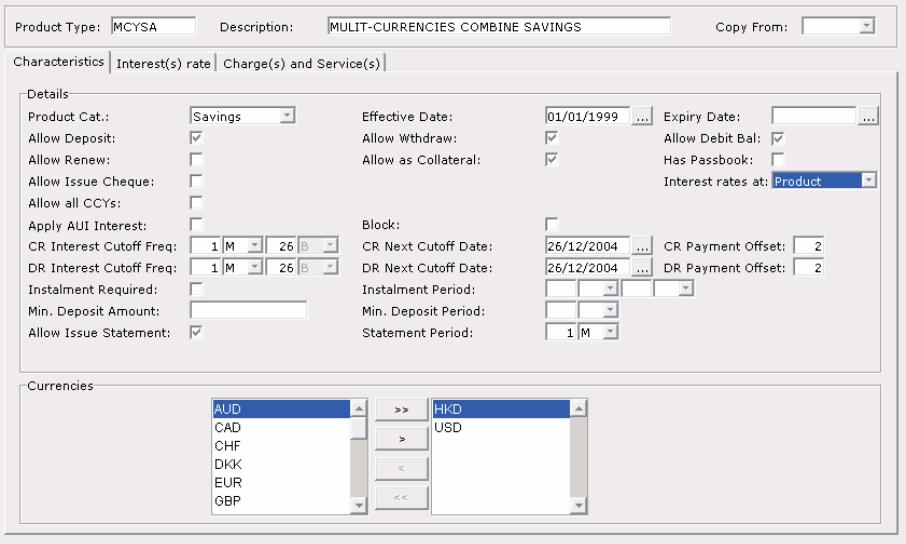

Retail Product Platform - define your own products

TIBS Retail Banking provides an integrated environment where bank users can create products on the fly, without costly development and testing cycles.

Products are no longer limited to traditional ones. New hybrid products can be created easily by clicking and selecting attributes. Interest rates can be set in multiple levels or tiers, and each tier with a variety of currencies, principal amounts, principal amount tiers, deposit tenors and rate types.

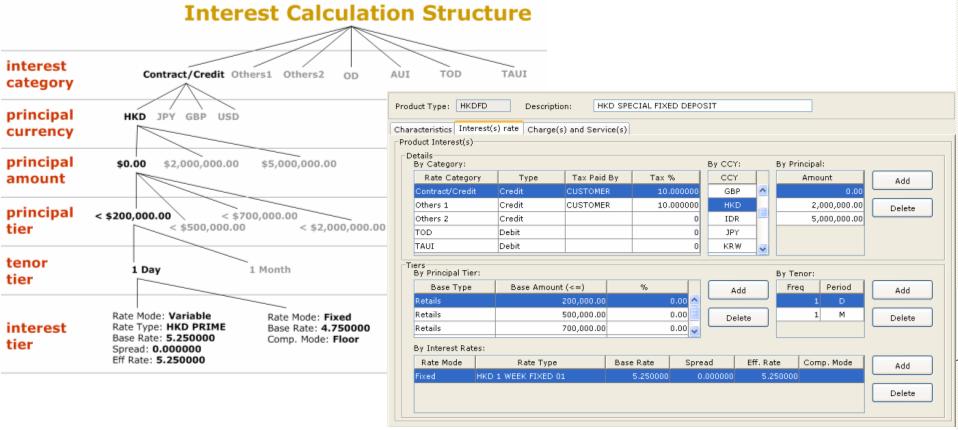

Comprehensive interest calculation structure

TIBS Retail Banking allows a single account to bear both credit and debit interests, and accrue them simultaneously. TIBS Retail Banking provides a hierarchical interest calculation structure that allows bank users the flexibility to define one or more interest categories per product. TIBS Retail Banking currently offers three credit interest categories (Contract/Credit, Others1, and Others2) and four debit interest categories (Overdraft, Temporary Overdraft, Against Uncleared Items, and Temporary Against Uncleared Items).

The credit and debit interest categories are further broken down by currencies, principal amounts, principal tiers, deposit tenors and rate tiers.

Interest calculation can also be based on different rate types such as HKD Prime, HIBOR, LIBOR, etc. When the underlying interest rates changes, TIBS Retail Banking automatically use the latest interest rate for the calculations. TIBS Retail Banking also supports different comparative modes, such as comparison for applying higher/lower interest rate done among different rate types. Interest rates can also be set to be capped by a ceiling rate, barred by a floor rate or both capped and barred.

Interest calculation structure not only at product level but also at account level

TIBS Retail Banking gives bank users the flexibility to define interest calculation structures at both product and account levels. When set to at product level, individual accounts follow the same interest calculation structure defined for the product. Any changes to the product immediately affects all accounts created from it. When set to at account level, the product level interest calculation structure is given as a default to the account and bank users may only add a special interest spread at each detail interest rate level on the account. When set to at account override, the product level interest calculation structure is given as a template for the bank user to freely compose the actual structure for a particular account.

TIBS Retail Banking gives bank users the flexibility to define interest calculation structures at both product and account levels. When set to at product level, individual accounts follow the same interest calculation structure defined for the product. Any changes to the product immediately affects all accounts created from it. When set to at account level, the product level interest calculation structure is given as a default to the account and bank users may only add a special interest spread at each detail interest rate level on the account. When set to at account override, the product level interest calculation structure is given as a template for the bank user to freely compose the actual structure for a particular account.