Products

| Highlights |

TIBS Loans

TIBS Loans is a full-featured Loans system. TechnoSolve has identified the constants and variabilities in characteristics of different loans products and created a platform that allows bank users to easily pick, choose and adjust these characteristics to put into their products without the need for costly development work and testing cycles.

- Dynamic multi-tiered interest calculation structure

- Various rate mode application

- Flexible interest start date

- Flexible repayment schedules

- User-definable product management

- Loans score card

- Staight-through loans processing

- User-definable loans classification and provision

- Documents management

- Dealer/salesman commission calculation

- Fees and charges management

- Comprehensive enquiry transactions and reports

Loans Product Platform - define your own products

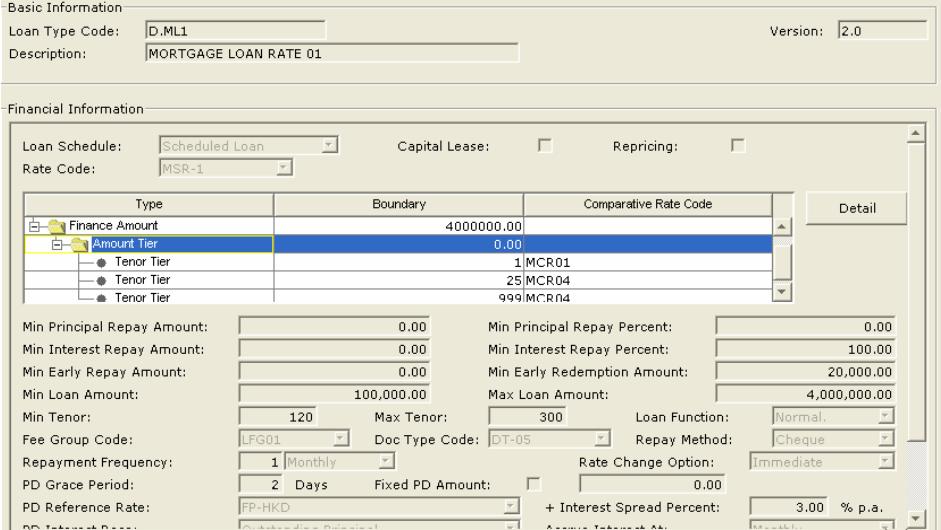

TIBS Loans provides an integrated environment where bank users can create products on the fly, without costly development and testing cycles.

Products created in TIBS Loans are not limited to the traditional loan types like personal loans, mortgages or hire purchase. TIBS Loans allows bank users to create products easily by selecting the relevant information such as repayment amounts, tenors, and interest calculation structures.

Dynamic multi-tiered interest calculation structure

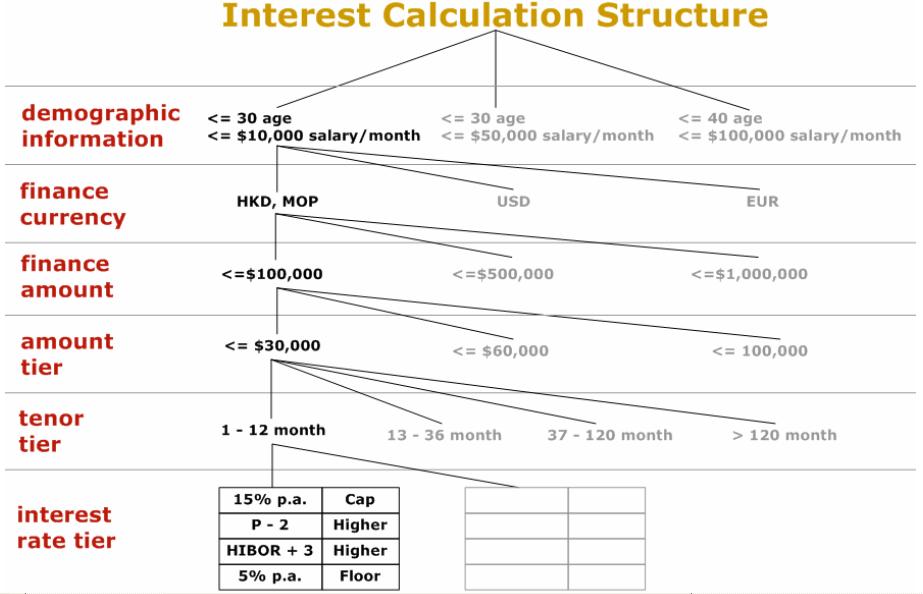

Interest calculation structure in TIBS Loans caters to various interest calculation methods. The structure can be set up with any combination of the various tiers of demographic information, finance currency, finance amount, amount tier, tenor and interest rate, with each tier further split up into various categories according to market needs. This means, bank users are given the flexibility to define the interest calculations based on a variety of factors built in TIBS Loans.

| TIBS Loans' interest calculation structure can be as simple as setting the tiers with finance currency, finance amount, amount tier, tenor tier and interest rate tier... ... or as sophisticated as including the tier of demographic information available in TIBS Customer Profile. |

Comparison and rate cap/bar setup

A set of criteria is used to calculate the interest for each category of the finance amount mentioned above. In these criteria, comparison for applying higher/lower interest rate can be done among different interest rates like Prime - 2 and HIBOR + 3. Further, it can be capped by a ceiling rate to protect the customer, barred by a floor rate to protect the bank, or both capped and barred.

User-definable loan classification

Loans are traditionally classified by different levels of overdue days. In order to provide more comprehensive information for loan monitoring purposes, TIBS Loans allows bank users to define additional dimensions by combining different levels of overdue days, loan to collateral ratios, etc. The grade changes for each view are independent of one another. Bank users may, according to different classification criteria, set up various views for different user groups - e.g. operational and managerial users, and for regulatory purpose.

|

To be prudent, a bank officer may monitor the loan performance of the customer tighter by downgrading the account status earlier than the regulatory requirement, while the bank manager may be more conservative and take relevant steps ahead. |